oklahoma franchise tax mailing address

Oklahoma levies a franchise tax on all corporations or associations doing business in the state. Our mailing addresses are grouped by topic.

Fill Free Fillable Forms For The State Of Oklahoma

Give Us a Call.

. Oklahoma Tax Commission Franchise Tax Post Office Box 26930 Oklahoma City OK 73126-0930 Phone Number for Assistance 405 521-3160. Local Phone Sales Tax Department. Franchise Tax Board PO Box 942867 Sacramento CA 94267-0001.

Oklahoma secretary of state 2300 n. Your message has been sent. Oklahomas franchise tax suspension has ended.

Corporations are taxed 125 for each 1000 of capital invested or otherwise used in Oklahoma up to a maximum levy of 20000 foreign corporations are assessed an additional 100 per year. Main Street Suite 1700 Wichita Kansas 67202 Search our websites. Form Without payment With payment Other correspondence.

Returns should be mailed to the Oklahoma Tax Commission PO Box 26800 Oklahoma City OK 73126-0800. Kansas City MO 64999-0002. While all corporations must file a report with the.

Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return. What is Oklahomas Franchise Tax. Please include your return payment balance sheet and schedules A B C and D.

To make this election file Form 200-F. The franchise tax is calculated at a rate of 125 per 1000 of capital employed in or apportioned to the businesss outpost in Oklahoma. Box 26930 Oklahoma City OK 73126-0930 Mandatory inclusion of Social Security andor Federal EmployerÕs Identification numbers is required on forms filed with.

Oklahoma Annual Franchise Tax Return. In Oklahoma the maximum amount of franchise tax a. Mail this return to the address below.

General Oklahoma Tax Commission Address. The filing is due July 1 2014 for the June 30 2015 period. Simply call 405 521-3160 or in-state toll free 800 522-8165 extension 13160 and select the option to.

Mail this return in the enclosed envelope. Taxpayer FEIN Write the correct federal employ-. Youll find a wealth of information on our web-.

If Incorrect Then 1. MMDDYY This page contains the Balance Sheet which completes Form 200. Registered office street address is 18 sheringham san antonio tx 78218.

Please include your return pay-ment made payable to Oklahoma Tax Commission balance sheet and schedules A B C and D. Incorporators have to include their names and mailing addresses. 7 rows and you ARE ENCLOSING A PAYMENT then use this address.

Eligible entities are required to annually remit the franchise tax. It will be used to establish your identity for tax purposes only. Box 110 Miami OK 74355.

Rural Electric Co-Op License. All tax tips and videos. Oklahoma Annual Franchise Tax Return Page 4 Taxpayer Name FEIN As of the Last Income Tax Year Ended.

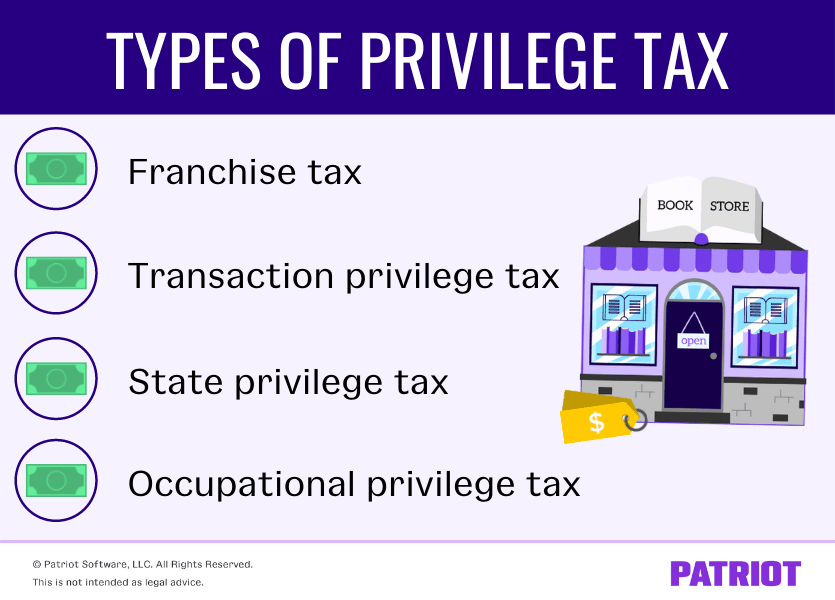

Oklahomas franchise tax is a tax on corporations for the privilege of. Thank you for contacting us. Oklahomas franchise tax suspension has ended.

Click here to return to home page. The in-state toll free number is 800 522-8165. Oklahoma Tax Commission Address Phone Numbers.

The franchise tax applies solely to corporations with capital of 201000 or more. Registered office street address is 18 sheringham san antonio tx 78218. Check e-file status refund tracker.

And interest for late payments of franchise tax 100 of the franchise tax liability must be paid with the extension. Franchise Tax Board PO Box 942840 Sacramento CA 94240-0040. Press 0 to speak to a representative.

Eligible entities are required to annually remit the franchise tax. Department of the Treasury. Oklahoma State Tax Refund Status Information.

If you hire us well be your incorporators. Oklahoma Franchise Tax Mailing Address. Oklahoma City OK 73126-0850.

Visit Us on the Web. You MUST provide this information. And you are filing a form.

The Oklahoma Tax Commission can be reached at 405 521-3160. Tax calculators. Items A or B or the name or address is incorrect.

540 540 2ez 540nr schedule x. Tax Tools and Tips. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

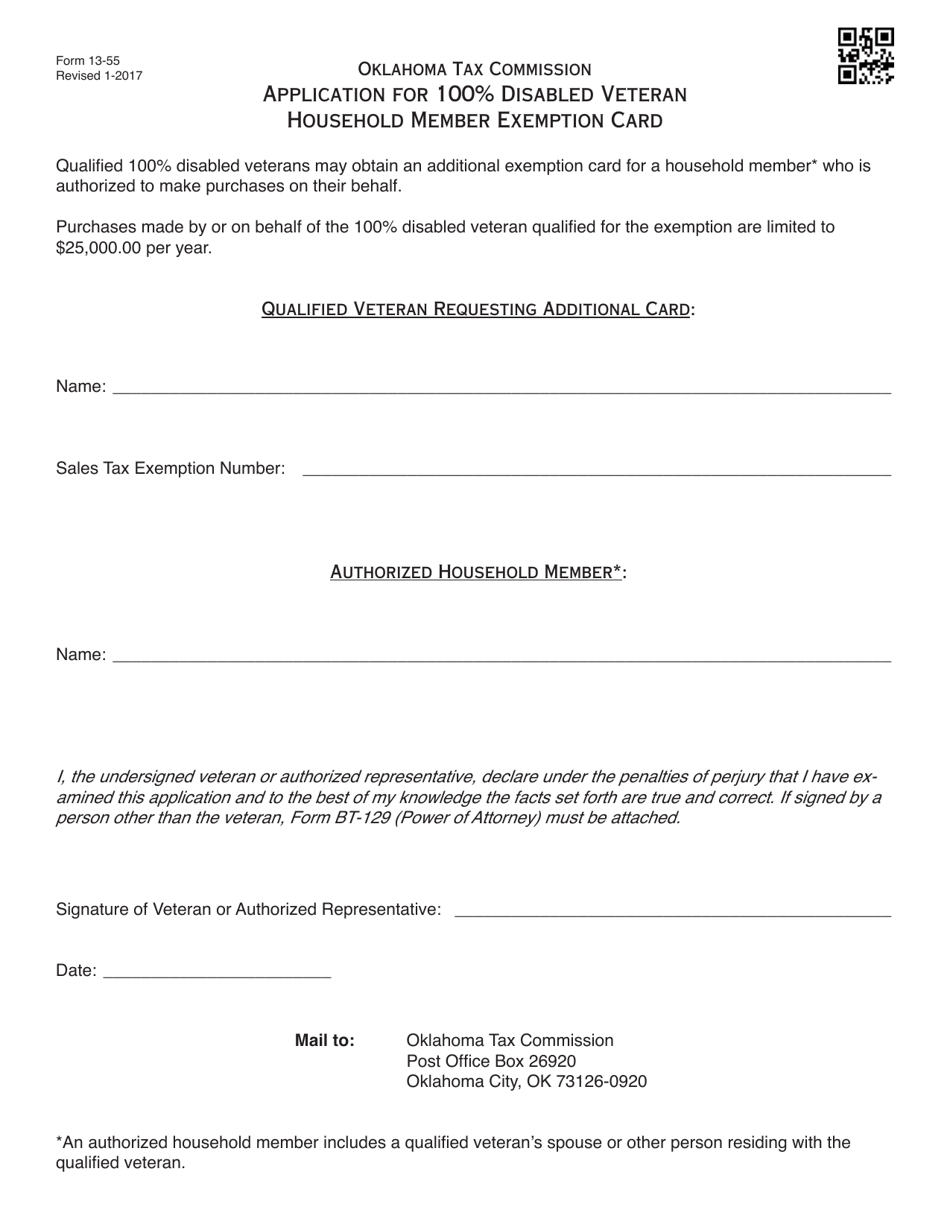

Our mailing addresses are grouped by topic. The filing is due July 1 2014 for the June 30 2015 period. Oklahoma Tax Commission Taxpayer Assistance Division Post Office Box 26920 Oklahoma City OK 73126-0920.

Franchise Tax Board PO Box 942840 Sacramento CA 94240-0001. Oklahoma Tax Commission Franchise Tax Post Office Box 26920 Oklahoma City OK 73126-0920 Phone Number for Assistance 405 521-3160. 540 540 2EZ 540NR Schedule X.

Toll Free Phone Sales Tax Department. Please make corrections in the space provided in Item H J or K. EditAdd a taxpayer level DBA Name and Mailing Address.

Incorporators dont have to be directors officers shareholders or anyone with ownership interest in the corporation. Oklahoma Tax Commission Franchise Tax PO. In oklahoma the maximum amount of franchise tax a corporation can pay is 20000.

The franchise tax applies solely to corporations with capital of 201000 or more.

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Where S My Refund Oklahoma H R Block

What Is Franchise Tax Overview Who Pays It More

Incorporate In Oklahoma Do Business The Right Way

Otc Form 13 55 Download Fillable Pdf Or Fill Online Application For 100 Disabled Veteran Household Member Exemption Card Oklahoma Templateroller

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Texas Annual Franchise Tax Report Filing File Today Zenbusiness Inc

Start A Nonprofit In Oklahoma Fast Online Filings

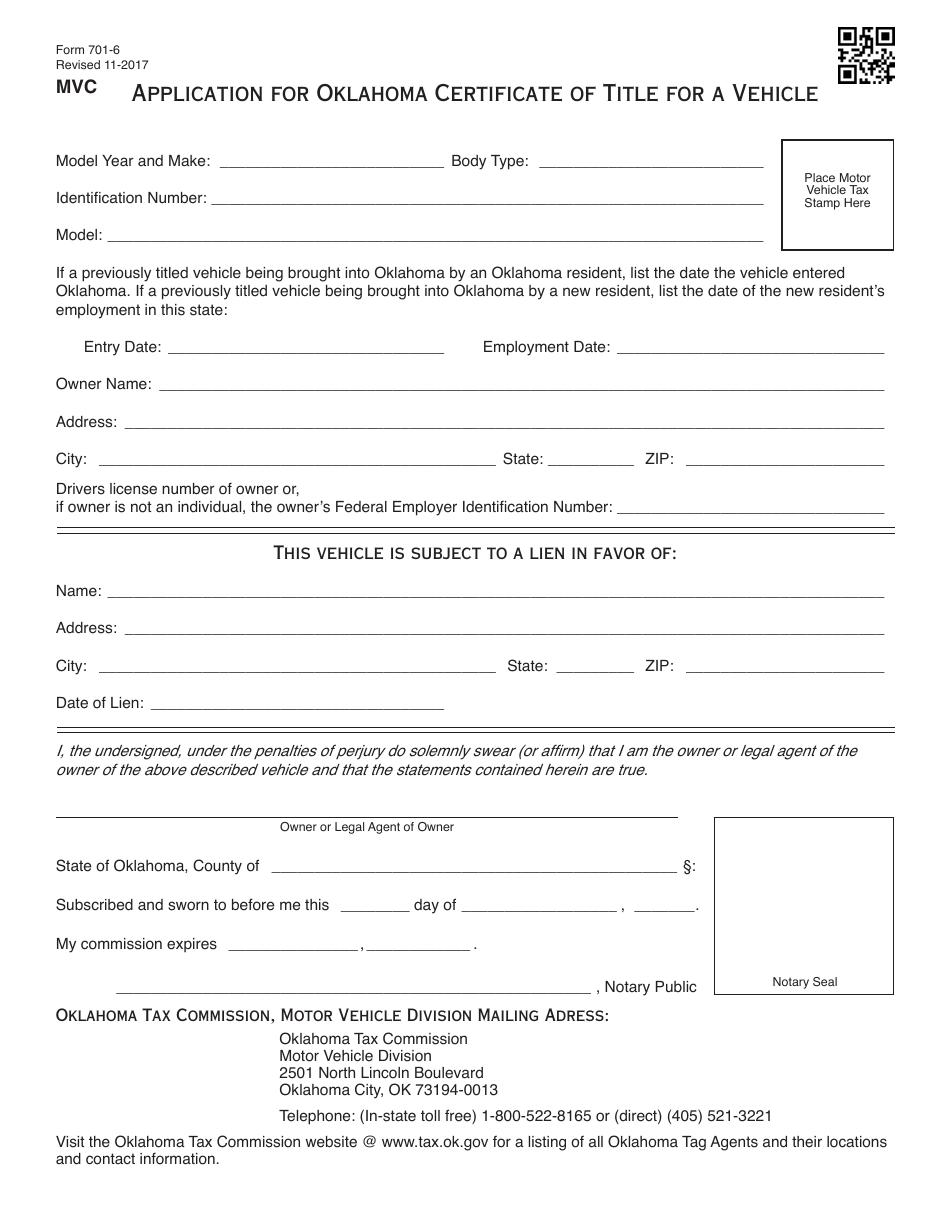

Otc Form 701 6 Download Fillable Pdf Or Fill Online Application For Oklahoma Certificate Of Title For A Vehicle Oklahoma Templateroller

Menu Home Search Browse Help Search Back Contact Us Support Signin Knowledge Base Home Search Browse Help Home Browse Drake Tax State Returns Oklahoma 13560 Ok After Ef Acceptance Taxpayer Receives Rejection Letter